2019 was a great year with lots of milestones and events to celebrate. The speed at which our family continues to grow amazes me. At the same time, it also scares me! Many of my older friends tell me how quickly this time passes and before you know it your kids are off to college. While having two young children presents its own set of challenges, it is a good reminder to cherish these times we have as a family.

2019 Family Review

Brielle’s 5th Birthday

We started out the year celebrating Brielle’s 5th birthday in January with a small party at our old house with some of her friends.

Spring

In April and May we were focused on buying our new house and moving from Mableton to East Cobb in Marietta

In May, Brielle graduated Pre-K from Kids R Kids in Mableton.

Summer Break

In June we went to Boston for our Niece’s birthday. The kids love getting to see their cousin and a lot of fun is had by all!

In July we went on a vacation to Hilton Head Island with the Forester family. This is the 3rd year we have done this and it is something that we look forward to each year! We are already planning Hilton Head 2020!

After Hilton Head, I headed out on a long around the world work trip while Crystal took the kids to Seattle to see her friend Tricia and her family.

Back to School

After a whirlwind summer with lots of travel, it was now time to go back to school with Brielle starting Kindergarten in Ms. Menear’s class at Mt Bethel Elementary School and Brendan starting pre-school at Mt Bethel Christian Academy.

In September we went to Blue Ridge Lake for a weekend to stay with my friend Greg and his family. The kids loved the lake and even got to take their first ride on a jet-ski!

Fall

Fall

Brielle joined her first soccer team “The Fire” and had a great time playing this season. She scored her first goal and is already signed up to play again in the spring!

For Labor Day our community hosts a “Cardboard Boat Regatta” that is a lot of fun. We entered with “Pinkatastic” and won the peoples choice award for best boat!

No year in review could be complete without an official school photo! I look forward to stringing these classic pictures along for many years to come!

We celebrated Brendan’s 3rd birthday with a dump truck cake and some candles that he really enjoyed blowing out!

In September we headed back to Boston to meet my new niece Maeve who was born this summer. We also made a visit to the Canobie Lake Amusement Park .

Halloween

After coming back from Boston, the kids were ready to celebrate Halloween for the whole month of October. It started with our Halloween Cards and T-shirts and continued with our family themed costumes. This year’s theme was pirates! Arggggggg!

Two days after Halloween Mt Bethel hosted their 33rd annual fun run. Brielle did great and got 4th place in her grade with a time of 4:17 for the half mile!

The Holidays

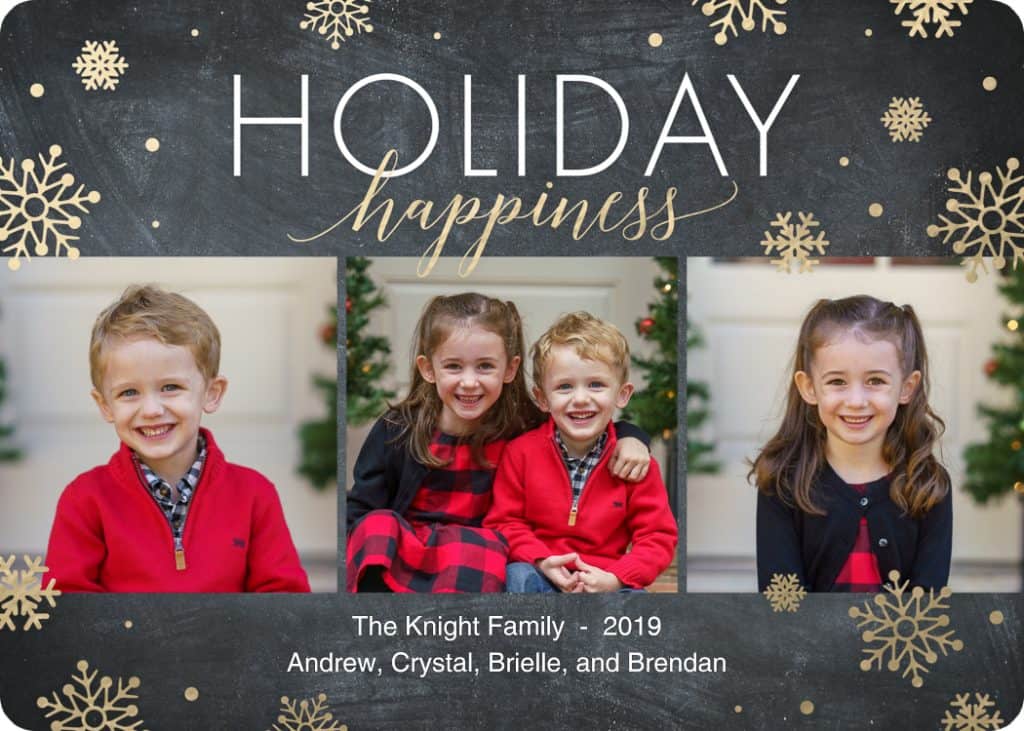

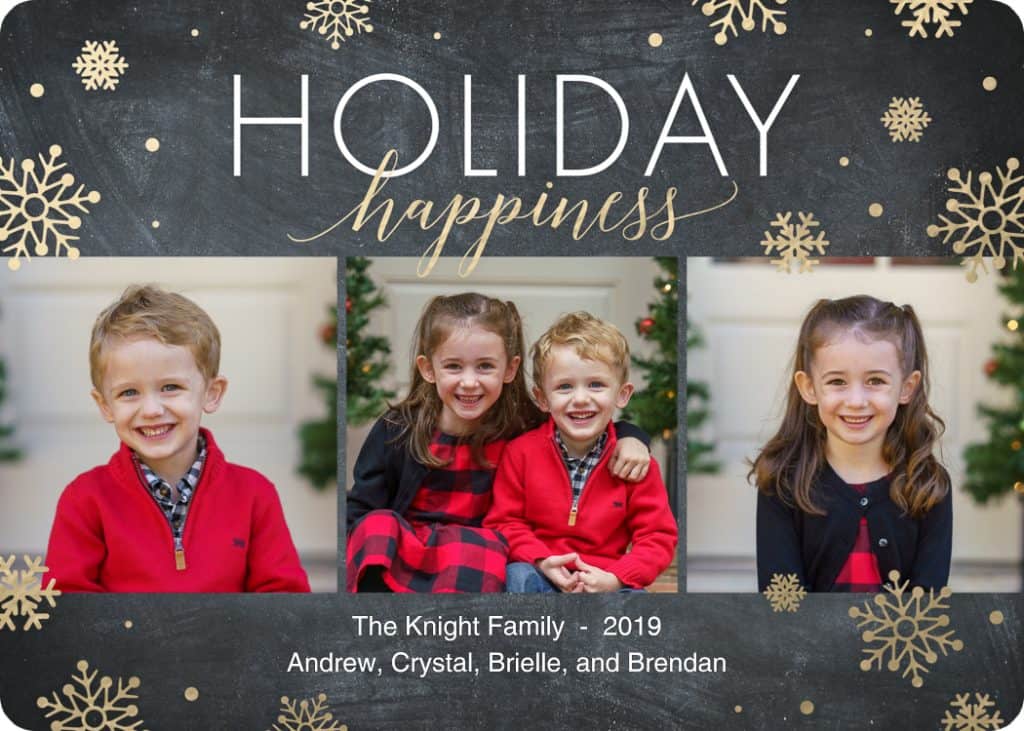

With Halloween behind us, the kids were excited to start thinking about Thanksgiving and Christmas! We got our holiday photo shoot done early this year so we could get our cards out with our new address:

Crystal continued her tradition of The Adventures of Snowflake our Elf on the Shelf. Her creative ideas keep the kids mesmerized each morning looking for her and what she could possibly be up to!

No Christmas season would be complete without a visit with the big guy himself. We had two Santa visits this year, one with Atlanta Swim and the other in our neighborhood

We had a great Christmas that included some matching Carter’s family PJ’s!

We had a great Christmas that included some matching Carter’s family PJ’s!

2019 Work Review

Managing the International Business for Carter’s kept me busy this year. I had 9 work trips: 3 domestic (all to New York) and 6 international trips flying a total of 140k MQM‘s on Delta. This was the 3rd year in a row that I made Diamond Medallion status. Here are all the places I went:

1) 2/26 New York

2) 4/10 New York

3) 4/13 Santiago , Chile

4) 5/20 London, UK

5) 6/08 Jakarta, Indonesia with additional stops in Bangkok , Thailand and Seoul, South Korea

6) 7/15 Riyadh, Saudi Arabia with additional stops in Dubai, UAE; Pune, India; Delhi, India; and Shanghai, China

7) 8/7 New York

8) 9/12 Moscow, Russia with additional stops in Warsaw, Poland; Berlin, Germany; and Cologne, Germany

9) 10/8 Sao Paulo, Brazil

We wish everybody a happy and prosperous 2020! Onto the next decade!

SmugMug Album

SmugMug Album