Great article by Jim Rutberg at USA Cycling profiling my return to racing, three national titles last year, and my preparations for the upcoming Masters Nationals in Augusta, Georgia!

Great article by Jim Rutberg at USA Cycling profiling my return to racing, three national titles last year, and my preparations for the upcoming Masters Nationals in Augusta, Georgia!

I am excited to be joining my friend Maggie as a co-host on her new podcast Inside Out Money. We posted our first episode this week:

003. How and why to invest in index funds

“A personal finance podcast focused on redefining wealth from the inside out.”

Like everything this year things were a little different for Halloween but one thing stayed the same: Crystal continued to up her game when it comes to the family costume. This years “Space Theme” was our best one yet!

Full SmugMug Album

Full SmugMug Album

COVID delayed the start of the school year but on October 5th Cobb County resumed in person learning. Since Brielle was going to be going back, we also decided to send Brendan to preschool. He started at a new school this year called Primrose which is run by our neighbor a few doors down from us.

Brielle did a great job making the best of virtual learning but she was ready to go back! After seeing her teacher and classmates on screen for so long she was so excited to meet all of them that she could barely contain herself this morning!

Crystal and I had gone apple picking years ago when we first moved to Georgia but we had not taken the kids yet. What better time to do it when everything is closed due to COVID! We drove up to BJ Reece Orchard in Elijay and had a great time picking some “Rome Beauty” apples. Crystal then baked some delicious apple pies with all the apples we picked!

It has been a crazy year and COVID continues to impact everything around us. We never thought that the 2020 school year would be at risk of starting virtual but as the cases counts kept growing over the summer the district made the decision o start the year with virtual learning. Even though Brielle did not get to go to school we still took her first day pictures!

It was not the same this year with the COVID restrictions but the kids still had fun decorating bikes and riding around the neighborhood.

This was not the kind of last day of school we had envisioned this year but we made the best of it. The kids have grown up so much this year!

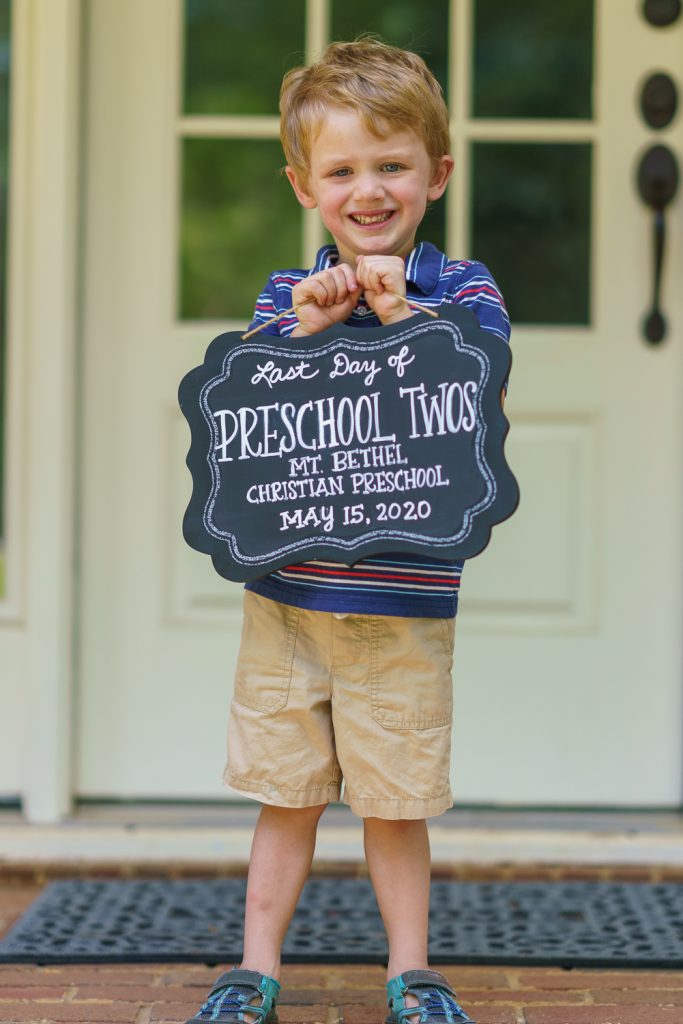

Brendan finished the Pre-School Twos at Mt. Bethel Christian Academy:

Brielle finished Kindergarten at Mt Bethel Elementary School:

Brielle’s teachers even stopped by to congratulate her and wish her well on her way to first grade which was really sweet of them!

This afternoon Brielle came running into my office saying I had to come outside to see a “huge hawk”. I was a little skeptical at first, but sure enough there was a red tail hawk sitting in our front yard holding onto a squirrel. I don’t get to shoot wildlife very often so I ran back inside grabbed my camera and 400m lens and started snapping pictures. What a beautiful creature!

Brendan also decided to get in on the action 🙂