The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

Author: John Bogle

Publish Date: March 5th, 2007

ISBN: 9780470102107

Amazon: https://www.amazon.com/dp/0470102101/

Table of Contents

Chapter 1 A Parable

Chapter 2 Rational Exuberance

Chapter 3 Cast Your Lot with Business

Chapter 4 How Most Investors Turn a Winner’s Game into a Loser’s Game

Chapter 5 The Grand Illusion

Chapter 6 Taxes Are Costs, Too

Chapter 7 When the Good Times No Longer Roll

Chapter 8 Selecting Long-Term Winners

Chapter 9 Yesterday’s Winners, Tomorrow’s Losers

Chapter 10 Seeking Advice to Select Funds?

Chapter 11 Focus on the Lowest-Cost Funds

Chapter 12 Profit from the Majesty of Simplicity

Chapter 13 Bond Funds and Money Market Funds

Chapter 14 Index Funds That Promise to Beat the Market

Chapter 15 The Exchange Traded Fund

Chapter 16 What Would Benjamin Graham Have Thought about Indexing?

Chapter 17 “The Relentless Rules of Humble Arithmetic”

Chapter 18 What Should I Do Now?

My Review

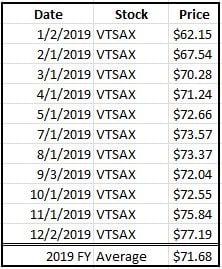

I have been a huge fan of Jack Bogle and Vanguard since I discovered them over 8 years ago. My sister had worked in the mutual fund industry so I had been blindly invested in mutual funds prior to investing in Vanguard. In 2012, I started reading more about the benefits of index investing and made my first Vanguard purchase of VFAIX on July 3rd, 2012. Over the next year, I would transfer all of my retirement accounts to Vanguad as well as opening a taxable brokerage account. After that first purchase of VFAIX, I switched to VTSAX and have been 100% investing in VTSAX since June of 2013.

While I had been a fan of Vanguard, and read lots of articles online about Jack Bogle, I had never read any of his books. After reading The Simple Path to Wealth last week, I decided I needed to read The Little Book of Common Sense Investing that is so widely praised and referenced in the financial independence community.

The premise of this book is very simple and Bogle does a great job summarizing the six key concepts in Chapter 17 that is applicably titled “The Relentless Rules of Humble Arithmetic” I will parapharse his six key messages as follows:

- Over the long term, stock market returns are created by real investments returns earned by real businesses: dividends and earnings growth

- Over the short term, speculative investments drive changes in equity prices based on how much investors are willing to pay for each dollar of earnings growth. These speculative investments are eventually a wash over the long term

- Businesses come and go. The best protection for individual investors against individual stocks is to own the entire market

- As a group, all investors earn the gross market returns before taking costs into account.

- While investors earn the entire market return they do not capture the entire market as fees, commissions, sales loads, and transaction costs eat away at returns. Gross market returns – costs = net returns for investors

- Mutual fund investors have real returns that are lower than the advertised net returns of the fund due to emotional market timing. Gross market returns – costs – timing and selection penalties = net retunrs for mutal funds.

There is a lot more to this book but these are the simple messages that are the foundation to his thinking and methodology. Some have criticized this book as being too simplistic in nature, but I enjoyed reading it. I have understood most of the benefits of indexing but Bogle goes into a lot of detail backing up his strategy. He uses a lot of math and numbers to explain the benefits along with this quote:

Remember O Stranger, arithmetic is the first of the sciences, and the mother of safety

The numbers and the math don’t lie and this book is very well researched with a ton of data behind it. He also does a nice job sprinkling in “Don’t take my word for it” segments from some of the biggest names on Wall Street and why they too believe that indexing is the way to go. The most famous investor of all time Warren Buffet has his four “E’s” quoted

The greatest Enemies of the Equity investor are Expenses and Emotions

I love this! It could not be any simpler or any truer. There is a reason it is called personal finance. In Buffet’s 2013 annual shareholder letter he goes into more detail:

My money…is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit. (I have to use cash for individual bequests, because all of my Berkshire shares will be fully distributed to certain philanthropic organizations over the ten years following the closing of my estate.) My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors—whether pension funds, institutions or individuals—who employ high-fee managers.

Bogle takes on the mutal fund industry in chapters 7, 8, and 9 and points out how bad a deal investors are getting from these funds and how over the long term they simply can not compete with index investing. After being a mutual fund investor for almost a decade I read these chapters and cringe! He also does a good job addressing the impact of capital flows and how “yesterday’s winners are tomorrow’s losers”. Investors pour money in during the bull market runs and pull money our during the bear markets. This is the exact opposite of what should be done and thus weighs on performance of mutual fund investors. His explanation on the difference between real returns of the mutual fund industry and advertised net returns is really well done:

To remind you, the nominal return of fund investors came to just 7.3% per year during 1980 to 2005, despite a wonderful stock market in which a simple S&P 500 index fund earned a return of 12.3%

If you have not read this book, I highly recommend it. If you are new to indexing, it is a must read and may be the most important book you read on investing. If you are already on the index train like I am, it will further reinforce this strategy and give you the confidence to stay the course. I only wish someone had handed me this book earlier in my investing career!

My Rating: 4 Stars