During the financial crisis of 2008, I started to figure out just how important the psychology of personal finance was compared to the math. The numbers and math are simple. If you save 10-15% of your income, and invest it for 40 years in a boring index fund you will end up with a pile of money at 65 to comfortably retire. So why is this so hard? Why do people not have more money saved for retirement? The simple answer is we are our own worst enemy:

- We don’t prioritize saving enough and get caught up in the consumerism of keeping up with the Joneses

- We try and time the market

- We buy high and sell low in a panic

- We don’t know how to evaluate risk

- We listen to all the media that have advocated and pushed this for decades. I am looking at you CNBC.

While my awareness to the mental aspects of personal finance started in 2008, it still took me a few more years to realize that dollar cost averaging was the single best way to fight and win against the psychology of money.

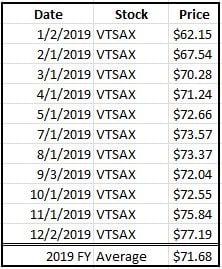

Like many things I write about, this concept is not complex or difficult to understand. Dollar cost averaging is an investment strategy where you buy shares over a period of time and the number of shares acquired fluctuates depending on the price at the time of purchase. In practical terms, a $500 investment each month in your Roth IRA is an example of dollar cost averaging. The same concept applies to your paycheck deductions for things like your 401k or HSA. You are making investments over a period of time and are continually investing regardless of the direction of the market.

This last statement is why dollar cost averaging is so powerful for personal finance. You no longer care which direction the market is going. If the market is up, GREAT my assets are appreciating, if the market is down, GREAT I am buying in when the market is on sale! I can’t tell you how liberating this concept is and how it changed my entire mental state regarding my personal finance invstments. I no longer worry about when to buy, since it happens automatically every two weeks! When you combine dollar cost averaging, with my 100% VTSAX investment strategy, you have a powerful system to achieve financial independance.

I want to emphasize that there is a lot of well respected research that suggests that lump sum investing is actually better in the long run than dollar cost averaging. My counter argument to this is that personal finance has never actually been about the numbers, it is about human behavior! So yes, lump sum investing may lead to higher theoretical returns dollar cost averaging is still a powerful tool. If you are deciding what to do with a windfall or inheritance that is a different story, and depending on your own situation and risk tolerance levels, you may prefer to put it all in at once. For me, I will continue on the slow, steady, and boring path of dollar cost averaging VTSAX to financial independence.