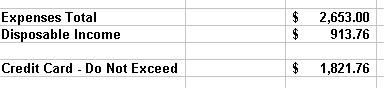

I have designed this foundational series to have all the articles build on each other. Once you have your monthly budget set and your income is greater than your expenses it is time to start figuring out the best way to save the money left over. Hands down the best method I have found for saving money is to have automatic withdraws from your savings account or paycheck.

This method is referred to as “Paying yourself first”. In my previous budget post there was a very clear reason why the income was at the top, followed by the 401k, ESPP, and Roth IRA and finally the bills and expenses last. This makes me think along the lines of paying myself first! Saving money is the first thing I do before any money is spent on bills and expenses. It is a fantastic way to think about finances and has worked really well for me!

David Bach’s book “The Automatic Millionaire†does a great job of driving this topic home and explaining how it works. I highly recommend it!

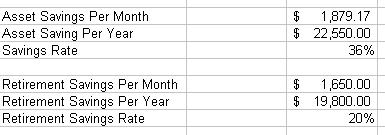

The great thing about this topic is how easy it is, well to setup that is. Leaving your allocations alone and having the discipline to not touch the money is the hard part. Set some aggressive goals in your budget, and work hard to reach them!

So where are the opportunities to setup automatic savings?

Savings Accounts

Setup a high yield savings account with WaMu or Emigrant Direct and setup a recurring transfer for 10% of your income. You will be amazed at how fast that account will grow and you will have a 6 month emergency fund in no time.

401k

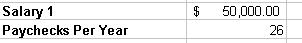

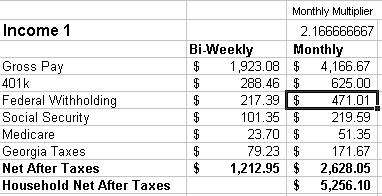

Most people have access to a 401k program at work. If you do, this is a great way to set up automatic savings. Set your 401k percentage, and put the money in some good growth stock mutual funds. A great method for increasing your 401k contribution is every time you get a raise increase your 401k percentage so the net impact to your paycheck is 0 and don’t upgrade your life style!

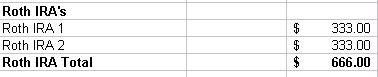

Roth IRA

Every Roth IRA I have seen has had an automatic investment option. Put $333 a month away and you can max your Roth IRA at $4k for the year

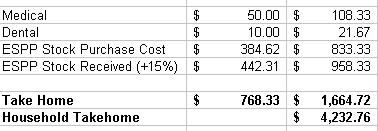

ESPP (Employee Stock Purchase Plan)

A lot of public companies offer this and it is an easy way to save money automatically. I will explain later how I take advantage of this at Home Depot.

Investment Brokerage Account

Just as a Roth IRA can be setup to make automatic investments, your standard brokerage or mutual fund account can also be setup to pull automatic investments out of your checking account.

With online banking, direct deposit, and electronic transactions there is no excuse why you should not make your savings automatic!