Personal finance success starts with a commitment to spend less than you make. However, where your spending falls in relation to your income can’t be known unless you map out all the money coming in and all the money going out. This is where the budget comes into play.

Budgeting for me is a fairly new concept. I have only been keeping a budget for the past year or so. During this time, I have been experimenting with a couple different methods to see what works. I have heard the envelope system is very effective but I don’t do cash (topic for another day) so I passed on that. I have tried recording all transactions in Microsoft Money or Quicken but I usually fall off that train pretty quickly. I think the key to budgeting is that it has to be simple. Since I like Excel I decided to start there and see how I got on. What I came up with is this Simple Monthly Excel Budget

*DISCLAIMER* All numbers are fictional and are just for display purposes!

Step 1)

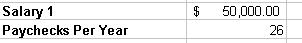

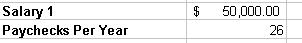

Enter Your salary and how many times a year you get paid. If you are a single income household just enter zero for salary 2

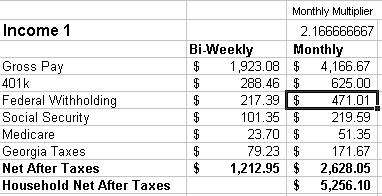

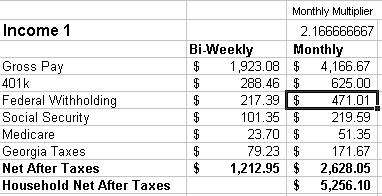

Step 2) Grab your paycheck or go to PaycheckCity and enter your information

:

Salary 1 is based on bi-weekly paychecks so I use a multiplier to get to the monthly numbers. Salary 2 is based on monthly paychecks. After entering your income, taxes, 401k (if applicable) you will have your net after taxes. This is the money you have to spend each month.

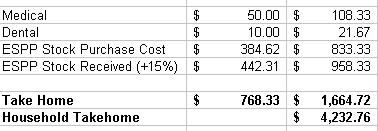

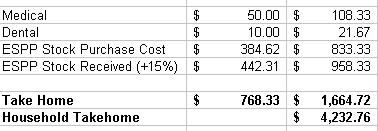

Step 3) Now it is time to enter your after tax deductions like medical, dental, and employee stock purchase (if applicable)

If you don’t participate in an ESPP just enter 0%. Now you have your take home pay in each check.

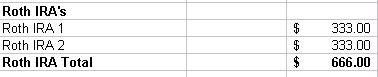

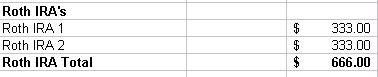

Step 4) Enter your Roth IRA information. If you are not participating in a Roth IRA enter zero (You should be – topic for another day!)

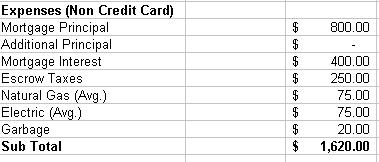

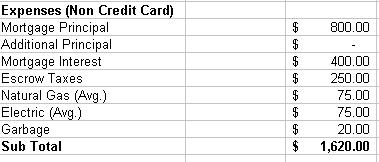

Step 5) Enter all your non credit card expenses. Things like mortgages, utilities, etc. For utilities that fluctuate, I enter an average since Gas and Electric will usually offset each other during the year. I also like splitting up the mortgage payments into principal, interest, and taxes so I can see the principal amount each month 🙂

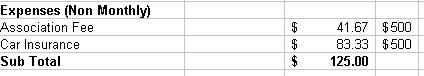

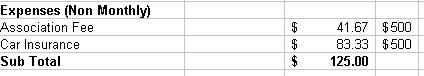

Step 6) Now enter your yearly expenses and divide by 12 to come up with a monthly average.

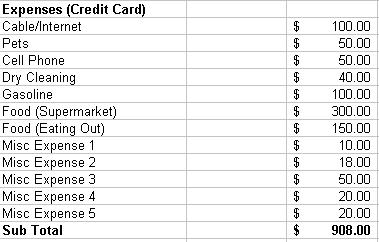

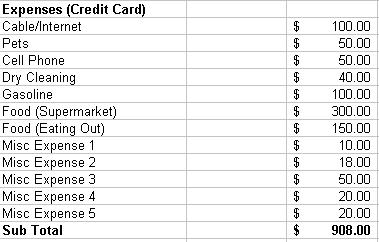

Step 7) Enter all your expenses that you put on a credit card each month. You will see why I do it this way next

Step 8 ) Now we add it all up!

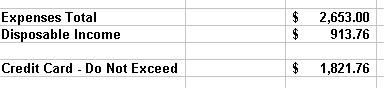

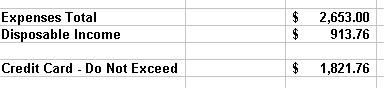

Your disposable income equals your take home pay minus your expenses and your Roth IRA contribution. This is how much wiggle room you have in your budget each month, hopefully it is a positive number! If it is a negative number, you need to cut some expenses or increase your take home pay.

I use the do not exceed line above so that each month I can glance at my credit card bill and make sure we are on track as most of our expenses are on the credit card each month.

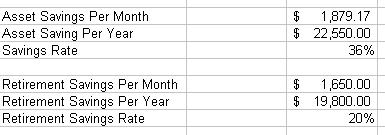

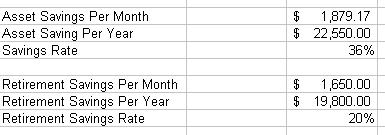

Step 9) The last couple lines give you a quick snapshot of how you are doing overall with a look at your savings and retirement rates.

So that is what works for me. What about you?